History

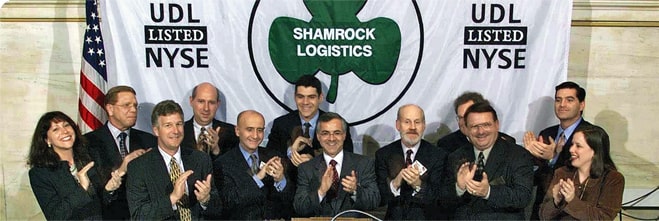

2001 - Shamrock Logistics L.P.

NuStar Energy L.P.’s history has been filled with dramatic growth and success, rising from humble beginnings in 2001 to become the rising star of the energy industry today. The partnership made its successful initial public offering (IPO) on April 16, 2001, when it was known as Shamrock Logistics L.P. and was part of the former Ultramar Diamond Shamrock (UDS) Corp. The partnership was soon renamed Valero L.P. after Valero Energy Corp. acquired UDS later in 2001.

2001 - Valero L.P.

“One of the best bonuses of the UDS acquisition was its limited partnership,” NuStar Chairman Bill Greehey said in 2002, who at the time was also Chairman and CEO of Valero Energy. “We plan to aggressively grow the L.P. to benefit the shareholders of both companies." Initially, Valero Energy Corporation owned about 74 percent of the partnership. In its first year, the L.P.’s network included 2,800 miles of refined product pipelines, 11 refined product terminals, 800 miles of crude oil pipelines and crude oil storage facilities with a capacity of 3.3 million barrels. With a strong financial base of about $92 million in annual revenues in its first year, the partnership’s steady financial and asset growth began with several acquisitions that helped to strengthen the network and build synergies within the L.P.’s system. In the next few years, the L.P. saw dramatic growth through acquisitions of refined product terminals, crude oil storage facilities, and pipeline systems throughout Texas, the U.S. West Coast, and Mexico. After purchasing several assets from Valero Energy in 2003, the L.P. also redeemed 3.8 million common units from Valero Energy to reduce Valero’s ownership interest in the partnership from nearly 74 percent to about 49 percent. This move deconsolidated Valero L.P. from Valero Energy’s financial statements, providing greater growth opportunities for both companies. With its continued successful expansions, the partnership decided to “go global.” In 2005, the partnership became one of the largest petroleum liquids pipeline and terminal operators in the United States. With the nearly $2.8 billion acquisition of Kaneb Pipe Line Partners, L.P., the partnership now had pipelines, terminals and bulk storage facilities located in most of the U.S., as well as Canada, Mexico, the Netherlands Antilles, the United Kingdom and the Netherlands.

2006 - NuStar Energy

By 2006, it became clear that complete separation of Valero Energy and the L.P. would be advantageous to both. “It is necessary to continue the process of separating Valero Energy and Valero L.P. to allow both companies to pursue their own strategic initiatives,” Greehey said at the time. “We expect that the complete separation of the L.P. from Valero Energy will better position the partnership for future growth." A new organization, Valero GP Holdings, LLC, which was subsequently renamed NuStar GP Holdings, LLC, was formed to assume Valero Energy’s ownership in the L.P. In July 2006 the GP had its IPO that consisted of approximately 41 percent of the units previously owned by subsidiaries of Valero Energy. A follow-on offering in December 2006 consisted of the remaining 59 percent, reducing Valero Energy’s ownership in the L.P. to zero. The NuStar Energy L.P. name and logo were unveiled in February 2007, and became official in April 2007 when the L.P. began trading as NuStar, with the NYSE ticker symbol, “NS.” And NuStar GP Holdings, LLC began trading under the symbol, “NSH.”

"Our new name says it all," said Greehey. "We are the new star in the energy business, and because of our employees' contributions to our success, we are at a very important turning point in the history of our company. With our newfound independence, we are now in a better position to continue growing and achieving even greater success in the years ahead." As a separate, independent company, NuStar continued to aggressively grow its operations not just through domestic and international acquisitions, but largely through billions of dollars in internal growth projects that significantly expanded efficiency and storage and transportation capacity, and made significant contributions to earnings. In 2008 NuStar also expanded into asphalt refining and marketing and became one of the nation’s leading asphalt producers with the purchase of East Coast asphalt refining assets. At the end of 2010, NuStar was ranked as the second fastest growing energy company in the Americas by Platts, and in 2011 the company purchased a small fuels refinery and a related pipeline and terminal in San Antonio, Texas. NuStar’s pipeline and terminal system has the advantage of having extensive pipeline and storage assets in and around all of the nation’s major shale plays, especially the lucrative and growing Eagle Ford Shale play in Texas. So NuStar decided in 2012 on a strategic redirection to focus solely on growing and expanding its pipeline and terminal operations in order to seize growing opportunities in that business segment. To achieve that, NuStar spun its asphalt operations off into a joint venture and retained 50 percent ownership in the operations. The Asphalt JV allowed NuStar to reduce its earnings volatility and debt, and it provided additional opportunities to invest in stable, high-return pipeline and terminal assets, while simultaneously giving the Asphalt JV the flexibility it needed to prosper in a more robust margin environment. And while NuStar had significantly upgrade improved the safety, environmental performance and reliability of the San Antonio refinery, it became necessary to divest the facility so that it could be owned by a refining company with resources and expertise to continue investing in the refinery.

In 2012, NuStar purchased an additional crude pipeline and storage system, as well as a gathering system in the Eagle Ford Shale region, and announced intentions to further grow its operations in that region and in the other shale play regions.

In 2015, on the heels of the U.S. government’s lifting of the federal ban on the export of crude oil produced in the United States, NuStar loaded what was believed to be the nation’s first export of U.S.-produced light crude oil at its Corpus Christi North Beach Terminal.

In 2017, NuStar made its entry into the Permian Basin by acquiring Navigator Energy Services, LLC.

“We are excited about starting 2017 with a strategic acquisition, and the addition of Navigator’s Permian assets marks NuStar’s entry into one of the most prolific basins in the United States,” said NuStar President and CEO Brad Barron.

This acquisition turned out to be a huge success for NuStar as the company increased throughput volumes by about 190% in less than two years. NuStar is uniquely situated to benefit from a number of Permian-driven opportunities, as its system sits atop some of the highest-quality acreage in the Permian. As NuStar has continued to grow, so have its investments in health, safety and environment, as well as staff, programs and systems. These investments resulted in one of the best safety and environmental track records in the industry. At NuStar, safety is the top priority and running a safe and ecologically sound operation is a core business value. In fact, NuStar has consistently been awarded the International Liquid Terminal’s Association’s (ITLA) Safety Excellence Award.

In 2018, NuStar Energy L.P. (NS) and NuStar GP Holdings (NSH) announced a definitive agreement that resulted in the merger of NSH with a wholly owned subsidiary of NS through a unit conversion resulting in approximately 13.4 million incremental NS common units outstanding after the merger was completed.

The merger resulted in NSH becoming a wholly owned subsidiary of NS and simplified NuStar’s corporate structure in a way that allowed the company to best position itself for long-term financial strength and sustainable growth. One of the biggest benefits the merger provided was lowering NuStar’s long-term cost of capital through the permanent elimination of the incentive distribution rights, which allowed NuStar to enhance its cash accretion from investments in organic growth projects.

Bill Greehey continued to lead the NuStar Board of Directors after the merger.

“NuStar has a bright future,” said Greehey. “We have great assets, great management and great employees. We just completed a major acquisition in the Permian, which is meeting, and in some cases, exceeding our expectations and will continue to be a great platform for growth.”

Along the way, NuStar has maintained its strong culture that puts employees first. As a result of that culture, NuStar has received numerous awards including being perennially recognized as one of FORTUNE Magazine’s “100 Best Companies to Work For.” NuStar has also been named as one of the “Best Workplaces for Millennials” (FORTUNE Magazine) and one of the “Best Companies for Latinos to Work” (Latino Leader Magazine).

“Our employees are NuStar’s biggest asset and the reason for all of our success,” said Barron. “NuStar has the best and brightest employees who care about the company, their co-workers and the communities where we have operations. We are excited about working with them to continue expanding our presence, improving our assets, increasing our unitholder value, making the company an even greater place to work, and making a positive difference in our communities."

In October 2022, Greehey retired from the Board and became Chairman Emeritus, and Barron added the title of Chairman of the Board.